The performance of cybersecurity investments (with D. Percia David, A. Mermoud, and M. Humbert)

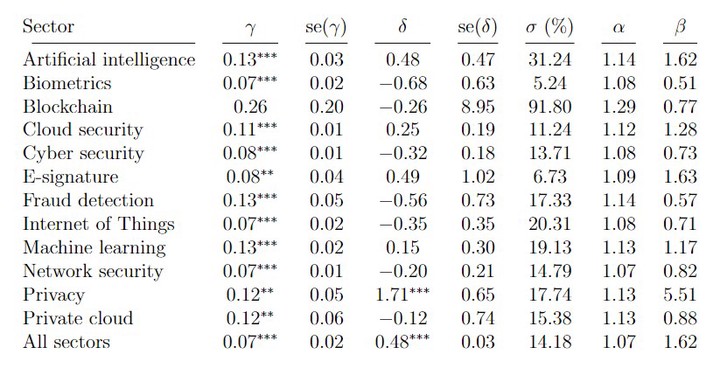

Log model regressions estimates and implied values for α and β

Log model regressions estimates and implied values for α and β

Early-stage firms play a significant role in driving innovation and creating new products and services, especially for cybersecurity. Therefore, evaluating their performance is crucial for investors and policymakers. This work presents a financial evaluation of early-stage firms’ performance in 19 cybersecurity sectors using a private-equity dataset from 2010 to 2022 retrieved from Crunchbase. We observe firms, their primary and secondary activities, funding rounds, and pre and post-money valuations. We compare cybersecurity sectors regarding the amount raised over funding rounds and post-money valuations while inferring missing observations. We observe significant investor interest variations across categories, periods, and locations. In particular, we find the average capital raised (valuations) to range from USD 7.24 mln (USD 32.39 mln) for spam filtering to USD 45.46 mln (USD 447.22 mln) for the private cloud sector. Next, we assume a log process for returns computed from post-money valuations and estimate the expected returns, systematic and specific risks, and risk-adjusted returns of investments in early-stage firms belonging to cybersecurity sectors. Again, we observe substantial performance variations with annualized expected returns ranging from 9.72% for privacy to 177.27% for the blockchain sector. Finally, we show that overall, the cybersecurity industry performance is on par with previous results found in private equity. Our results shed light on the performance of cybersecurity investments and, thus, on investors’ expectations about cybersecurity.