Cyber risk and the cross-section of stock returns (with D. Celeny)

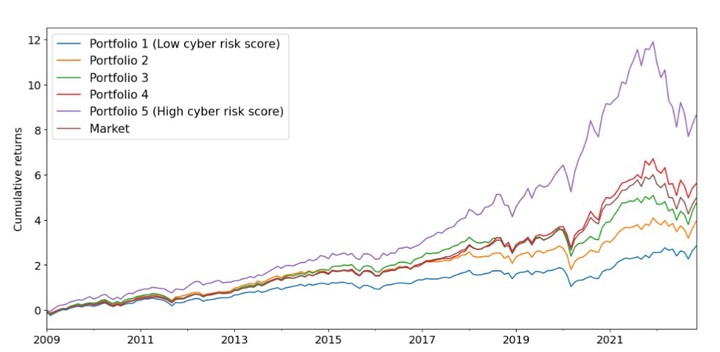

Cyber risk-sorted portfolios cumulative returns

Cyber risk-sorted portfolios cumulative returns

We extract firms’ cyber risk with a machine learning algorithm measuring the proximity between their disclosures and a dedicated cyber corpus. Our approach outperforms dictionary methods, uses full disclosure and not devoted-only sections, and generates a cyber risk measure uncorrelated with other firms’ characteristics. We find that a portfolio of US-listed stocks in the high cyber risk quantile generates an excess return of 18.72% p.a. Moreover, a long-short cyber risk portfolio has a significant and positive risk premium of 6.93% p.a., robust to all factors’ benchmarks. Finally, using a Bayesian asset pricing method, we show that our cyber risk factor is the essential feature that allows any multi-factor model to price the cross-section of stock returns.