The new risk and return of venture capital investments (with F. Burguet and A. Mermoud)

Boosted trees regression of post-money valuations

Boosted trees regression of post-money valuations

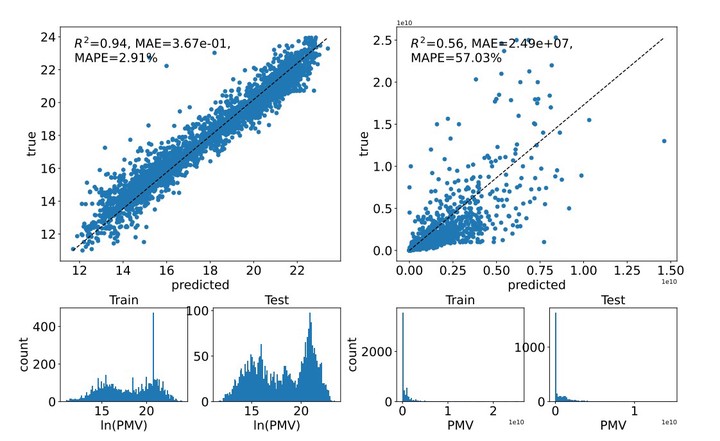

n this paper, the authors estimate the risk and return of venture capital investments with selection bias correction. They use an up-to-date dataset and enhance it to account for missing valuations using machine learning. They infer, with a median error of less than 4%, the true log value of the firm for a total of nearly 120,000 observations from 2010 to 2022. They find an annualized expected return of around 38%, an annualized CAPM alpha of 32.14%, a beta of 1.37, and an idiosyncratic risk of 40%.